Announcements

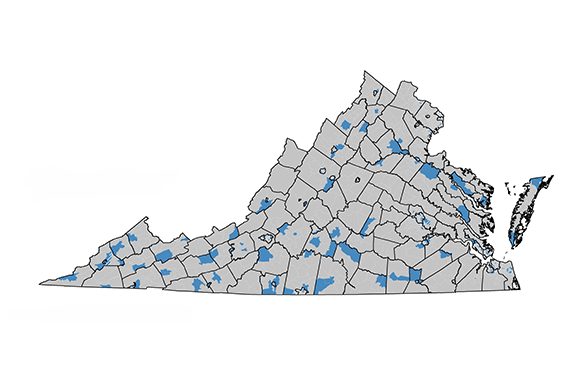

Press Release -- Governor Northam Announces Federal Designation of 212 Qualified Opportunity Zones

Press Release -- Governor Northam announces nomination of 212 Opportunity Zones

Press Release -- Governor Northam Announces Initiative to Encourage Economic Growth in Virginia’s Opportunity Zones

How do Opportunity Zones Work

Taxpayers can get capital gains tax deferral for making timely equity investments in Opportunity funds that then deploy capital into Opportunity Zone business and real estate ventures. This is an economic and community development tax incentive that provides an avenue for investors to support distressed communities to address areas of the Commonwealth that have experienced uneven economic growth and recovery. The tax incentive offers three benefits; tax deferral, tax reduction through long-term investment, and exclusion of certain capital gains tax.