The Commission on Local Government (CLG) promotes and preserves the viability of Virginia’s local governments by fostering positive intergovernmental relations. The CLG assists cities, counties, and towns in various ways. Click through the following to learn more about what we do.

The commission is composed of five members appointed by Governor and confirmed by the Virginia General Assembly. The members are required by statute to have knowledge and experience in local government, and they can hold no other elective or appointive office while on the commission. Find out more about the CLG, including meeting agendas and minutes.

A cash proffer is (a)any money voluntarily proffered in a writing signed by the owner of property subject to rezoning, submitted as part of a rezoning application and accepted by a locality pursuant to the authority granted by Va. Code Ann. Section 15.2-2303 or Section 15.2-2298, or (b) any payment of money made pursuant to a development agreement entered into under authority granted by Va. Code Ann. Section 15.2-2303.1. The CLG is responsible for producing an annual report on local government’s collection and expenditures of cash proffers for each fiscal year.

Fiscal impact statements provide local governments an opportunity to advise legislators of the likely costs of proposed state mandates before the bills become law. Pursuant to § 30-19.03 of the Code of Virginia, the CLG is required to file, with the General Assembly, a fiscal impact statement for each bill identified by the Division of Legislative Services, the Department of Planning and Budget (DPB) and others as likely to impose on one or more local governments a net additional expenditure, a net reduction of revenues or both.

The fiscal stress index is a relative index, which is the aggregation of analyses on the comparative revenue capacity, revenue effort and median household income for Virginia’s cities and counties. The fiscal stress index illustrates a locality’s ability to generate additional local revenues from its current tax base relative to the rest of the commonwealth. Primary users of this index are local governments in Virginia and various state agencies, who use the index to assist in the allocation of state aid to the 95 counties and 38 cities in Virginia.

The Catalog of State and Federal Mandates on Local Governments is updated annually and approved by the CLG in September. The catalog is an online, interactive database of all state and federal mandates on local governments identified as of July 1 of each year.

In accordance with Executive Order 58, the commission annually establishes a mandate assessment schedule for state agencies. The schedule is subject to the governor’s approval.

Find out information about Virginia localities by clicking through the following topics.

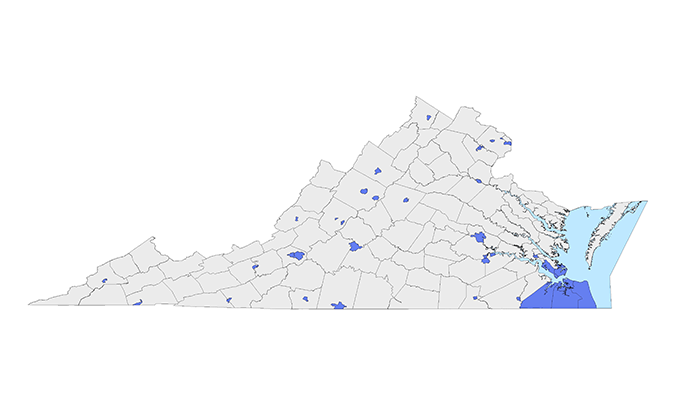

Learn more about the population, geography and functional authority of Virginia’s 95 counties, 38 cities and 190 towns.

Learn more about the taxing powers and direct financial assistance for Virginia’s localities.

Virginia has 21 planning district commissions (PDCs), voluntary associations of local governments intended to foster intergovernmental cooperation by bringing together local elected and appointed officials and involved citizens to discuss common needs and determine solutions to regional issues.

Transition and Local Technical Assistance and Reports

One of the commission’s chief duties is to provide technical assistance to localities and state agencies on the state’s boundary change and governmental transition processes. Find reports, technical assistance, and information about boundary changes and governmental transition processes.